The inflation market is “red hot”?

- 22 Ottobre 2021 (7 min di lettura)

The inflation market is super-charged these days. The chart below shows 5y inflation swaps in GBP (red), USD (blue) and EUR (white). Year-to-date, we are +150bp in GBP, +105bp in USD +125bp in EUR. Please find below a quick comment by Jonathan Baltora (PM inflation) and myself on the inflation market.

Where is inflation coming from?

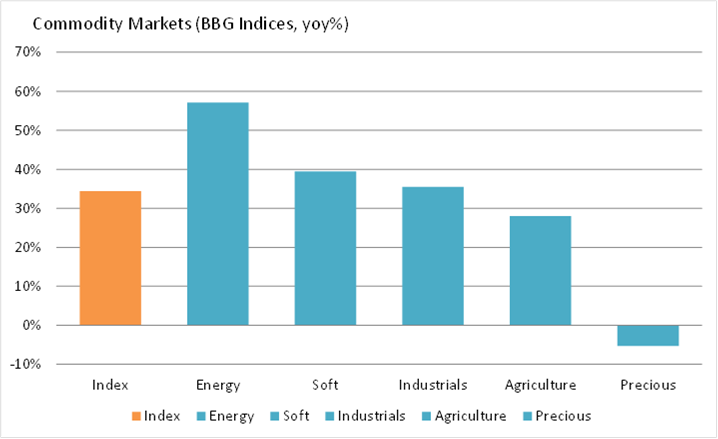

So far essentially from energy and COVID-related components. This is why economists are saying that inflation is transitory. In fact, commodity markets are up 34% yoy, with a positive contribution not only from energy, but also from other sectors. Food inflation is also something we’re focusing at, as it might trigger political instability. Of course, we will have transitory base-effects from commodities, but these are increasingly complex to price into longer-dated inflation expectations.

What do people expect from here?

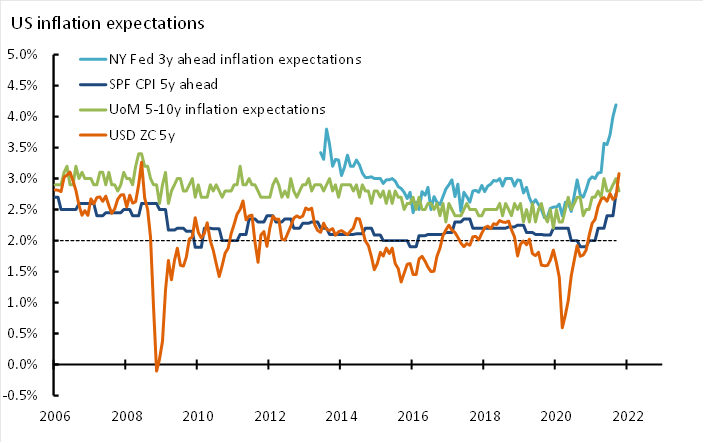

As we can see, inflation expectations from businesses and consumers are rising. This is concerning, because we’re looking at long-dated expectations (e.g. 5 years). In essence, both the inflation market and surveys are slowly taking the view that inflation is becoming stickier. This change in narrative could have severe implications for monetary policy in the near term.

Inflation and emerging markets

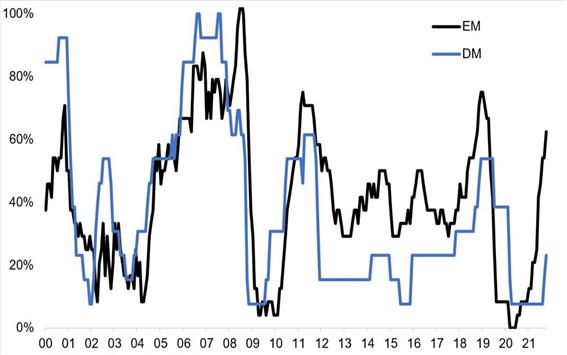

EM central banks in particular have tightened monetary policy with large policy surprises. For example, the Central Bank of Russia has hiked rates by 75bp today, while analysts were expecting only 25bp. We note how >60% of EM central banks have already tightened policy and how DM central banks are somewhat reluctant to hike rates. This is not just a reflection of EM’s complexity – they have to cope with the FX es well – but also of the fact that inflation hits everybody, albeit the impact is more pronounced for lower income countries.

The Fed, the Boe and the ECB

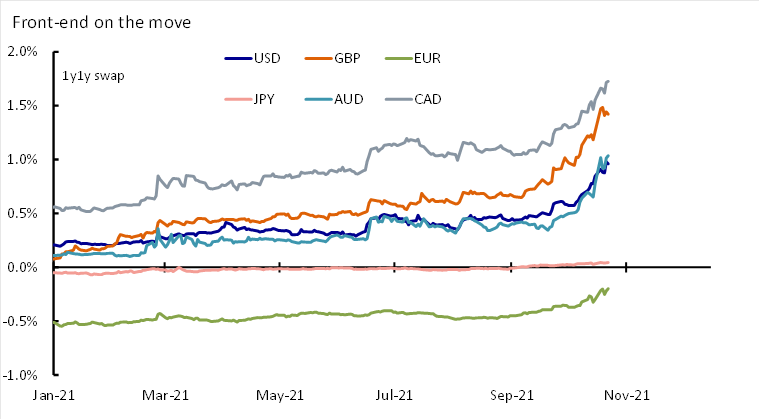

“Systemic” central banks continue to beat the “transitory inflation” drum, expecting inflation rates to abate toward the end of 2022. Unfortunately, markets start to question this view, also in light of the string of surprises in incoming data. Hence, we’re seeing strong pressure under the front-end in several currencies. For example, expectations are now for the BoE to start hiking this year, while the initial rate hike by the Fed is still priced in around Aug/Sep-22.

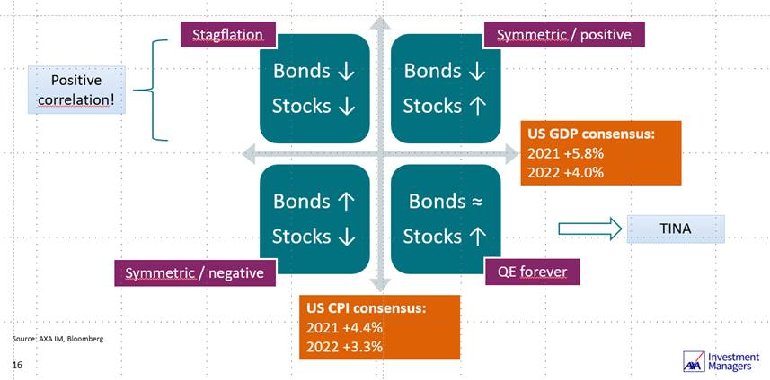

What is the problem, then?

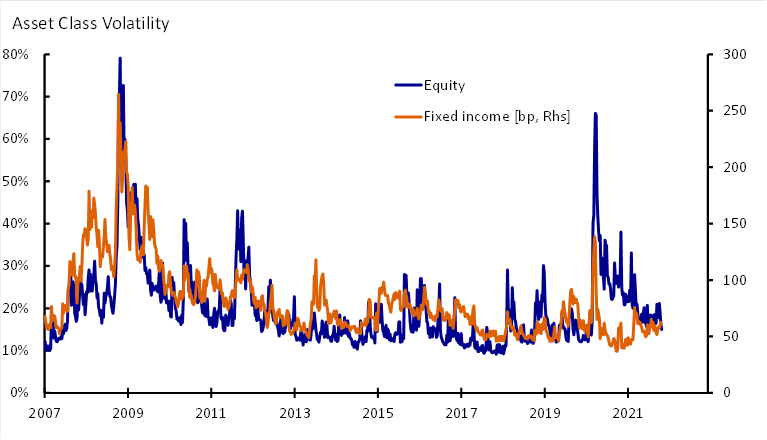

The problem is that we might be in for a so-called “asymmetric shock”, i.e. one where inflation accelerates and output slows down. Why is this such an issue? Because monetary policy is not the right tool in this scenario. Think about it: What would a central banker do? Hike rates to cool down inflation or rather cut rates to support employment and income? It’s a policy dilemma and as such might increase uncertainty, volatility and risk premia. Please note I have not used the word “stagflation”, which is 1) a nightmare for every investor and 2) a utopia for every economist.

Where is secular stagnation?

We had such a situation in the late 1970s when the Federal Reserve was conducting a “stop and go” policy, with dismal results to say the least. Looking at market volatility, we are not pricing in this scenario at all…in any case, one may argue that we’re in for a u-turn on the secular stagnation theme, even more so as Larry Summers himself is now saying there might be something deeper behind inflation than just base effects. Allow me to be blunt: If you can answer the question “what is the opposite of secular stagnation?”, then you probably can also construct the perfect portfolio for the next decade.

Looking into the future

There are three medium-term upside-inflation risks in our view: Less globalisation / more fiscal spending / the green revolution. In addition, we also think that the world in a state of transition, in particular we’re now trying to fix offshored and ultra-concentrated supply/value chains, which will take time. Sometimes it might take years, as with semiconductor supply. And time is a luxury good, it’s utterly expensive. The risk is therefore, that we’ll have to live with higher inflation rates than in the past. And for longer.

Strategy

Large impact from central bank buying. However inflation breakevens remain closely correlated to macroeconomic indicators which suggest that we are not in a bubble. The market prices in transitory inflation. Furthermore, long-term inflation breakevens do not seem to embed too large inflation premiums. We think it’s too early to fade the inflation trade as inflation still risks rising over the coming months. Our favorite strategy is to buy short term linkers. Best way to capture inflation indexation in our opinion with limited duration risks. Inflation breakevens may peak once inflation starts to surprise to the downside, but we are not here yet.

-

Ogni martedì alle ore 11.00 Alessandro Tentori, CIO di AXA IM Italia, vi invita a riflettere insieme sui mercati e su possibili soluzioni di politica economica. Per l'iscrizione, cliccare qui.

Disclaimer

Comunicazione di marketing: Prima dell’investimento in qualsiasi fondo gestito o promosso da AXA Investment Managers o dalle società ad essa affiliate, si prega di consultare il Prospetto e il Documento contenente le informazioni chiave per gli investitori (KID). Tali documenti, che descrivono anche i diritti degli investitori, possono essere consultati - per i fondi commercializzati in Italia - in qualsiasi momento, gratuitamente, sul sito internet www.axa-im.it e possono essere ottenuti gratuitamente, su richiesta, presso la sede di AXA Investment Managers. Il Prospetto è disponibile in lingua italiana e in lingua inglese. Il KID è disponibile nella lingua ufficiale locale del paese di distribuzione. Maggiori informazioni sulla politica dei reclami di AXA IM sono al seguente link: https://www.axa-im.it/avvertenze-legali/gestione-reclami. La sintesi dei diritti dell'investitore in inglese è disponibile sul sito web di AXA IM https://www.axa-im.com/important-information/summary-investor-rights.

I contenuti pubblicati nel presente sito internet hanno finalità informativa e non vanno intesi come ricerca in materia di investimenti o analisi su strumenti finanziari ai sensi della Direttiva MiFID II (2014/65/UE), raccomandazione, offerta o sollecitazione all’acquisto, alla sottoscrizione o alla vendita di strumenti finanziari o alla partecipazione a strategie commerciali da parte di AXA Investment Managers o di società ad essa affiliate, né la raccomandazione di una specifica strategia d'investimento o una raccomandazione personalizzata all'acquisto o alla vendita di titoli. L’investimento in qualsiasi fondo gestito o promosso da AXA Investment Managers o dalle società ad essa affiliate è accettato soltanto se proveniente da investitori che siano in possesso dei requisiti richiesti ai sensi del prospetto informativo in vigore e della relativa documentazione di offerta.

Il presente sito contiene informazioni parziali e le stime, le previsioni e i pareri qui espressi possono essere interpretati soggettivamente. Le informazioni fornite all’interno del presente sito non tengono conto degli obiettivi d’investimento individuali, della situazione finanziaria o di particolari bisogni del singolo utente. Qualsiasi opinione espressa nel presente sito internet non è una dichiarazione di fatto e non costituisce una consulenza di investimento. Le previsioni, le proiezioni o gli obiettivi sono solo indicativi e non sono garantiti in alcun modo. I rendimenti passati non sono indicativi di quelli futuri. Il valore degli investimenti e il reddito da essi derivante possono variare, sia in aumento che in diminuzione, e gli investitori potrebbero non recuperare l’importo originariamente investito.

Ancorché AXA Investment Managers impieghi ogni ragionevole sforzo per far sì che le informazioni contenute nel presente sito internet siano aggiornate ed accurate alla data di pubblicazione, non viene rilasciata alcuna garanzia in ordine all’accuratezza, affidabilità o completezza delle informazioni ivi fornite. AXA Investment Managers declina espressamente ogni responsabilità in ordine ad eventuali perdite derivanti, direttamente od indirettamente, dall’utilizzo, in qualsiasi forma e per qualsiasi finalità, delle informazioni e dei dati presenti sul sito.

AXA Investment Managers non è responsabile dell’accuratezza dei contenuti di altri siti internet eventualmente collegati a questo sito. L’esistenza di un collegamento ad un altro sito non implica approvazione da parte di AXA Investment Managers delle informazioni ivi fornite. Il contenuto del presente sito, ivi inclusi i dati, le informazioni, i grafici, i documenti, le immagini, i loghi e il nome del dominio, è di proprietà esclusiva di AXA Investment Managers e, salvo diversa specificazione, è coperto da copyright e protetto da ogni altra regolamentazione inerente alla proprietà intellettuale. In nessun caso è consentita la copia, riproduzione o diffusione delle informazioni contenute nel presente sito.

AXA Investment Managers può decidere di porre fine alle disposizioni adottate per la commercializzazione dei suoi organismi di investimento collettivo in conformità a quanto previsto dall'articolo 93 bis della direttiva 2009/65/CE.

AXA Investment Managers si riserva il diritto di aggiornare o rivedere il contenuto del presente sito internet senza preavviso.

A cura di AXA IM Paris – Sede Secondaria Italiana, Corso di Porta Romana, 68 - 20122 - Milano, sito internet www.axa-im.it.

© 2025 AXA Investment Managers. Tutti i diritti riservati.